In the decade since the global financial crisis, real estate markets have thrived from favorable demographics, job growth, a growing economy, strong property fundamentals, rising property values and low interest rates. Because of these factors, lending has also reached a record high.

However, in 2018 we have seen the first signs of slowing loan origination, paired with rising interest rates and indications that we are indeed late in the cycle. Commercial and multifamily loan originations fell 3 percent from the second quarter of 2017 and 7 percent from third quarter of last year. The drop off in lending in the third quarter was driven by a 30 percent decline in hotel loans, a 28 percent decrease in retail loans and a 17 percent dip in office loans. On the other hand, multifamily originations in the third quarter rose by 13 percent.

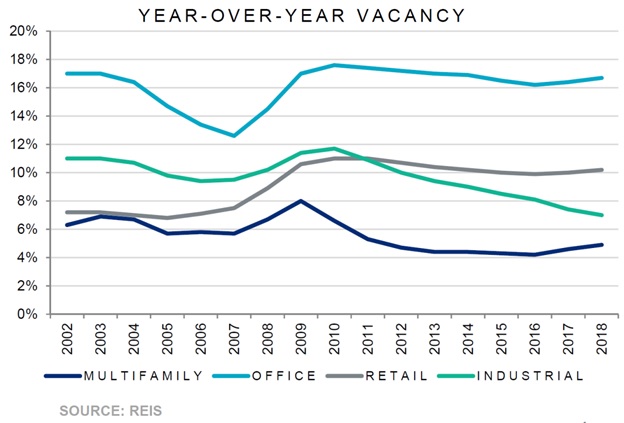

Multi-family value-add is shaping up to be best positioned to succeed at this point in the cycle. Multi-family vacancy is still relatively low and is the lowest comparison to other sectors, such as office, retail, and industrial. Also, value-add opportunities continue to take advantage of under-managed properties.